Condo vs. Coop - What are the Differences?

When the New York City apartment hunt begins for would-be apartment buyers, one of the first things they need to start considering is whether they want to purchase a condominium ("condo") or cooperative ("coop"). However, while hearing the terms on the city streets may be as commonplace as hearing about how the stock market is doing, many don't know the many differences and trade-offs between condos and coops.

The Condo

In New York City, a condo is an apartment that a buyer owns outright. It is similar to the legal structure of owning a house, except there are many shared elements, such as basic building infrastructure, hallways, amenities and so forth.

A beautiful NYC condo with Empire State Building views

The Coop (Co-op)

A coop is a legal entity, such as a corporation, that distributes shares to its buyers. These shares provide the coop share owner access to the common elements and their residence.

One of the most exclusive coops in NYC, The Sherry-Netherland

So what are the other big differences between condos and coops besides the ownership structure?

Market Supply

In Manhattan, approximately 75% of all apartment buildings are coops. The other 25% are condos. All new developments are built up as condos, so generally speaking, coops represent some of Manhattan's older inventory. However, newer doesn't necessarily mean better quality. Many coops have gone through major renovations over the years and come with great prestige.

Overall, the apartment supply in NYC is fairly low, so developers can't build new buildings and convert old ones into condos fast enough. With the recent recession and a several year construction slowdown, there are not enough condos to meet the growing demand. Construction is booming again all over the city, including Manhattan, Brooklyn and parts of Queens. As more condos get built in Manhattan, the 75% to 25% ratio will keep shifting from coops to condos, but it won't reach parity anytime soon.

Getting Approved

Coops have been known to have a very strict, regimented approval process. Generally, coops may want to see more than the traditional 20% down payment. In many cases, coops will want 25% and in come cases even more. But that's not where it stops. Here are some of the things that are important for coop boards when going through the approval process:

- Apartment Sales Price

- Net worth

- Income

- Debt

- Tax Returns

- References

- Background Check

- Resident Status

- Interview Performance

Sounds like a screening for a job at the FBI, but this is just a normal process for going the coop board application process. In many cases, the interview may feel quite subjective, and it is always wise to have a real estate broker help prepare your board package and help you get ready for the interview.

Condos are not nearly as selective about the approval process. Generally, you need to be able to show a mortgage commitment and enough funds in reserve to be able to pay the taxes and common charges. There is no interview process.

Additionally, as coops are much stricter for their approval process, liquidity is much lower. International investors generally will not buy coops, except in rare cases where coops are "investor friendly," meaning that they allow foreigners to buy as well as quickly rent out the apartment upon closing. These restrictions have a direct impact on the overall liquidity of coops, which has a direct impact on the price of coops as compared to condos.

Prices

The combination of overall apartment inventory as well as the liquidity greatly impact the price differences between condos and coops. Additionally, there is generally a great premium placed on new developments, and much of the condo inventory is new developments.

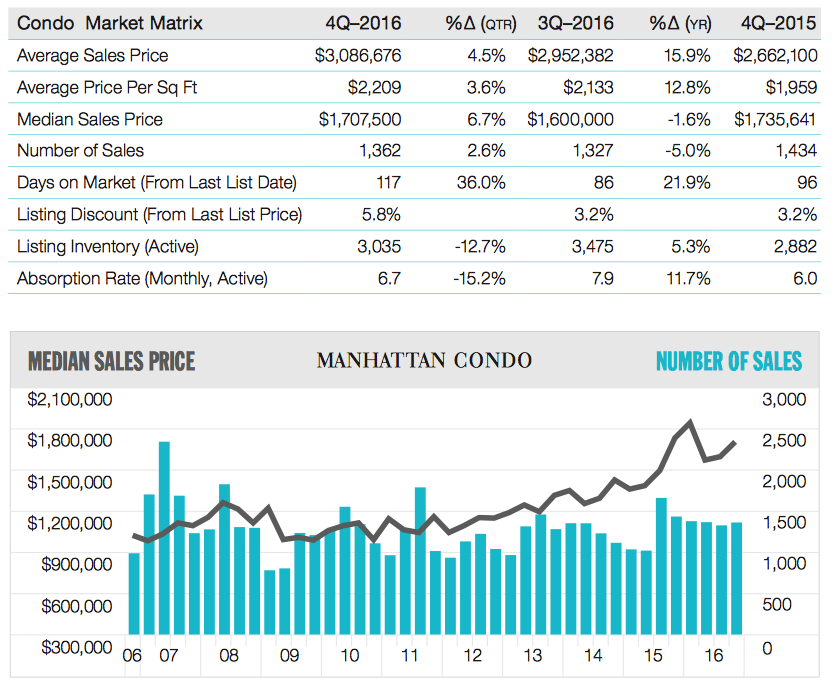

According to a Douglas Elliman report for Q4 2016, the average sales price for a Manhattan co-op was $1,202,354 with an average price per square foot of $1,195. Compare that to the average sales price of condos at more than $3,000,000 and an average price per square foot of $2,209. That's quite the large discrepancy. Refer to the charts and metrics below. It is important to note that condo price averages are heavily influenced by high-end sales and luxury new developments. Therefore, definitely make sure to take a look at the median sales prices.

Manhattan Co-Op Market Matrix, Q4 2016

Manhattan Condo Market Matrix, Q4 2016

One thing to also keep in mind is that foreign investors are dominating the condo market, which means that the coop market has less competition. For a price-conscious local buyer, the coop may be the easier route to go if one does not wish to compete with international bidders and investors.

Read: Are Co-Ops Good Investments?

Rules and Regulations

Coops are known to have much stricter rules imposed against owners than condos. Restrictions could include pet policies, subletting allowances, guest limitations and so forth. This really comes down to lifestyle. Some people may be uncomfortable with such strict rules. Additionally, for some, the subletting rules may be a non-starter.

As you can see, there are many things that set condos and coops apart. Ultimately though, they are both equally an integral part of New York City's real estate market. As condominiums continue coming to market, their popularity will continue to increase. However, so will their price points, so this is really where there is a give and take and where the coop will continue to shine.

The Apartment Search Begins Here

Begin the process here at Blooming Sky, and we'll help you find an apartment that you will love, in addition to being a great investment. Get in touch with us for a complimentary consultation.