Buying a New York City Apartment with Bitcoin

You've probably heard of the term cryptocurrency over the past year. Digital currencies that are encrypted and don't require central banks to regulate them are one of the fastest growing asset classes.

The digital currencies that are receiving the most attention are Bitcoin, Ehtereum and Litecoin.

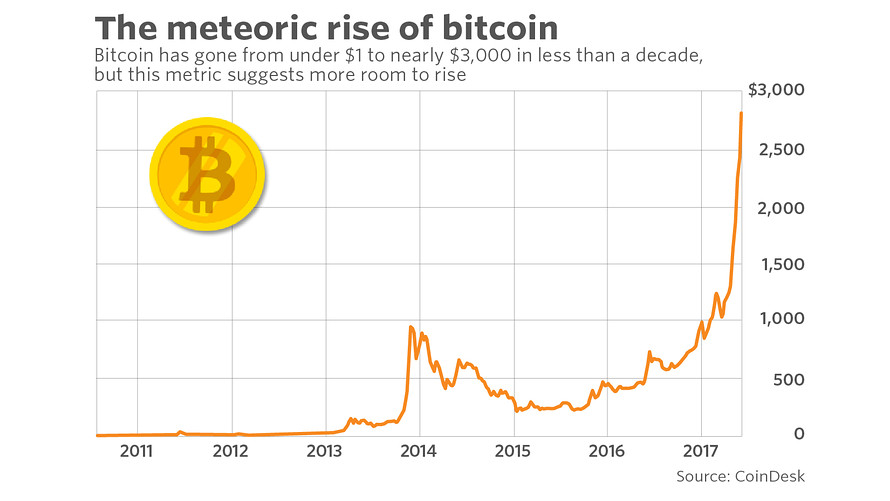

Bitcoin's rise has not been met without extreme market volatility and questions of security along the way. With an astronomical increase in value over the past 8 years, bitcoin started in 2009 and was initially valued at fractions of a penny. The first major transaction that was able to peg a USD value to bitcoin was when someone paid 10,000 BTC for 2 pizzas valued at $25. By mid-2017, 1 BTC has approached nearly $3,000 in value! Goldman Sachs says it even has the possibly to rise another 50% in the near term.

December 2017 Update - Bitcoin continues its record ascent and is fast approaching the $10,000 for 1 BTC mark.

Current value of 1 BTC

With such a rapid ascent in value, many investors of the currency have started wondering what they could purchase with their newfound wealth. Many online and offline retailers have started experimenting with accepting bitcoin and using the blockchain technology and bitcoin wallets to facilitate the transaction.

Of course, spending a few dollars here and there on an online transaction for a video game is one thing and spending hundreds of thousands on a property is something completely different. Given bitcoin's most recent valuations, the time is here when owners of the digital currency are starting to think about what other types of investments they can purchase with the currency.

Bitcoin Marketplaces are Growing

BitPremier is a luxury marketplace where buyers can purchase anything from plots of real estate in the Caribbean all the way to fine art.

Bitcoin Real Estate allows sellers of properties to list their residences and connect with buyers who are interested in paying in bitcoin, while still providing the USD cash equivalent. However, this site acts purely as an advertising listing service and will not actually facilitate the transaction.

"As in the early days of the internet, the industries that incorporate the use of blockchain will develop protocols to support an endless array of transactions, which will help reduce costs and risks and improve transparency and liquidity" says Alex Teyf who leads an effort to connect businesses with cryptocurrencies and blockchain across a number of industries.

Real Estate Transactions in the Bitcoin Era

Numerous reasons exist why a buyer may want to pay for a New York City apartment with bitcoin. They include, but are not limited to the following:

- Rebalancing investments into other asset classes

- Cashing out of an investment in bitcoin and purchasing a real estate investment

- Remaining anonymous throughout a real estate transaction

- Transferring money out of a country with significant political instability and/or currency controls (i.e. China, Russia, etc...)

- Ability to hide source of funds

New York City condominiums have always been a favorite for real estate investors and foreign nationals that want to get the benefit of relaxed property laws within the United States. Bitcoin has essentially become the new Swiss Bank.

Do Sellers want to Accept Bitcoin?

The short answer is: It depends. The majority of property owners are likely not too familiar with bitcoin. However, the opportunity lies in the real estate brokerage community to help sellers understand the global market that is immediately opened up through the influence of digital currencies.

However, a seller's desire to accept bitcoin will not limit someone who wants to spend their bitcoin on property from doing so. For instance, if a buyer has $1,000,000 USD equivalent in BTC and wants to buy an apartment with it, all he or she would have to do is exchange the bitcoin via an exchange such as Coinbase or GDAX, convert it into USD and bring a check to the closing table. This means that technically speaking every real estate transaction could take place with bitcoin being converted to the cash equivalent prior to the actual closing. It's really no different than a buyer liquidating stocks before a closing to have enough cash on hand.

Parties Involved in a New York City Real Estate Transaction

There are several parties involved in a property transaction in NYC. For a bitcoin transaction to be successful, these parties must all be familiar with the blockchain technology and have an understanding of its monetary equivalent.

- Real Estate Brokers

- Mortgage Brokers / Lenders

- Real Estate Attorneys

- Title Company

If a buyer is financing the purchase and plans to use bitcoin as the downpayment and/or liquid cash reserves, the lender must be comfortable with understanding that bitcoin are to be treated similarly to other investments. When speaking with a lender from Bank of America, he mentioned that when proof of liquidation was provided to underwriting, the cash was able to be used for the downpayment and closing costs.

Title companies play an essential role in the purchase process because they provide insurance that the title of the property is clean and transferrable. During closing, they also handle the disbursement of all the funds between the buyer, seller and lender. For disbursements to be handled properly with bitcoin, title companies will need to start adapting to technology that will enable them to use bitcoin to settle transactions and enable buyers and lenders to be paid in either bitcoin or USD equivalent.

Vista Abstract was the first title company to enable the purchase of real estate using bitcoin. This is a large leap in the real estate world and has significant implications for the future of real estate transaction. Vista only operates in several select markets. New York City is not yet one of them.

Facilitating the Bitcoin Property Purchase in NYC

While the parties that are accepting bitcoin and other cryptocurrencies continues to grow, the easiest way to purchase a residence in New York City using the blockchain currency is as follows:

- Work with Blooming Sky to help identify a choice property

- Prior to contract signing, ensure the exact BTC needed for downpayment is exchanged for USD equivalent

- Consider setting up LLC if the goal is to protect privacy

- Sign contract and provide downpayment

- Work on receiving financing from lender, unless it will be an all bitcoin deal (i.e. all cash deal)

- Schedule closing

- Exchange the remainder of BTC needed for the rest of funds required

- Close on the property

2018 Bitcoin / Manhattan Real Estate Update

We have the official 2018 update for buying an apartment in New York City with Bitcoin. It is now possible to directly purchase select condos in Manhattan directly with Bitcoin. This is an exciting time for Bitcoin owners who are looking to divest their cryptocurrency holdings and turn them into one of the world’s most desired asset classes, NYC real estate.

Blooming Sky is the Premier Bitcoin Real Estate Broker in NYC

We understand technology and your real estate needs. We connect the world of luxury real estate to the world of digital currency. Having worked with elite technologists to purchase condominiums and townhouses, we have a proven track record. We also provide clients access to our professional network of real estate lawyers and lenders to help you facilitate your property purchase using bitcoin.

Looking to start the conversation? Send us a note below. We'd love to hear from you.